Since the first ATM was installed in New York in September of 1969, there has been a flurry of evolution in banking—from improving the customer experience and reducing long lines to creating quicker transactions. Banks and financial institutions are continuously responding to the need for innovative technology that creates smoother, faster, and more convenient banking interactions. In recent years, banks have turned to voice technology as a means to optimize the customer experience, and the interest in voice AI as a banking solution is taking off.

According to a study by Benori Knowledge, 75% of respondents from banks with over $100 billion in assets are currently implementing voice AI strategies. Many large financial institutions such as Bank of America, U.S. Bank, Capital One, and American Express have joined in on the trend to offer quick, responsive experiences to their customers through voice technology.

The data also shows that the customer demand for fast, convenient, and conversational banking is growing exponentially. A study by Capgemini discovered that 28% of users of voice assistants have used one to make a payment or send money, and 44% expressed an interest in using voice AI for bank transactions. Banking and finance institutions are realizing the benefits of voice user interfaces in their mobile apps and call centers to meet the growing consumer demand for natural, hands-free interactions.

As part of a series of interviews about voice AI in the financial industry, Keri Roberts, Brand Evangelist at Read Speaker, spoke to Mike Zagorsek, COO of SoundHound Inc. about the integration of the Houndify Voice AI platform into banking applications, the current state of voice AI in the financial industry, and SoundHound’s vision for the future of voice AI.

During the interview, Keri and Mike discussed a range of topics around voice assistant adoption in the banking and finance industry. You can view the interview in its entirety here or read the recap.

Keri: Where do you see the banking and finance vertical going with voice AI?

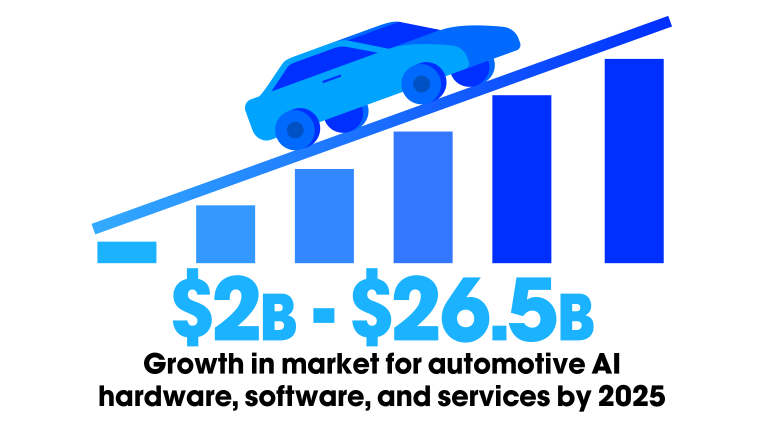

Mike: When you look at voice AI across industries, each one is evolving at a different rate and in a different direction. You have automotive, and they’re on their journey. Then you have the IoT companies and this broad realm of service and enterprise organizations that don’t necessarily make physical products. Banking is a great one to focus on because they’ve been increasingly aggressive in the voice AI space.

There are two subcategories of voice AI adoption in the financial markets. One is banks and financial service organizations adding their skills to third-party assistants like Alexa and Google. The other half is organizations building their own custom voice experiences. They’re each doing it slightly differently. Some organizations are doing both. It all comes down to how a bank, as a financial services organization, can be where their customers are. As a result, we’re seeing mostly the larger organizations invest in this space.

Any organization that is providing a service in a physical, remote, or third-party location is investing in voice. It’s a cost-savings and a customer improvement.

Keri: SoundHound recently worked with Opus Research to survey a variety of industries, including financial services. What did the research show in terms of usage of conversational AI?

Mike: The research overall showed that two-thirds of organizations cross-industry are actively exploring voice assistants, and banking was no exception. The banking industry is focused on providing services where their customers are. The Opus Research Report discovered that 75% of respondents from large banks said they’re currently implementing various forms of AI strategies. The owners of smart speakers themselves are increasingly looking to use banking services. The trajectory, if you’re part of a large bank, is that you’re already seeing that there are various forms of voice assistants.

Keri: What are some use cases or potential use cases for the banking industry?

Mike: A user can ask complex statements, such as “show me checks I deposited in the last two months”, which avoids a lot of taps. It’s quick and responsive.

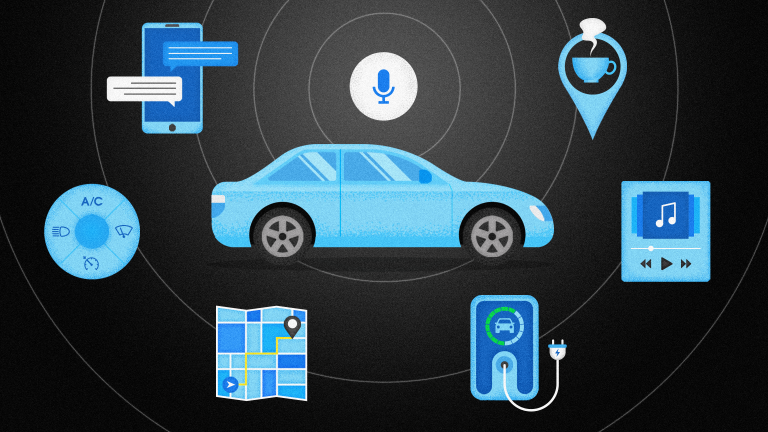

Many of the bigger banks are exploring custom voice assistants, as an omnichannel solution which extends their brand directly to their customers. They’re not accessing the company through Alexa or Google but speaking to them directly. The predominant place we’re seeing custom voice assistants is through a mobile app experience. Bank of America is a prominent one where their Erica voice assistant is unlocking features and capabilities directly through the app. That’s powerful because simple use cases work better with voice.

Next, banks start imagining that the voice experience they have in their app is the same as the one they have on their website, phone, or ATM. A voice-first omnichannel experience is the prize. Banks who are pursuing omnichannel experiences will find that they can build central voice AI that services customers using conversational interfaces and language.

Our Houndify technology is fundamentally different from everything else out there. The typical process is a user speaks and makes a query, and that query gets turned into text. Then the NLU (Natural Language Understanding) process takes that text and turns it to meaning. It’s essentially two steps to translate what was said into texts and then determine the meaning. Our Speech-to-Meaning® and Deep Meaning Understanding™ technologies do it in real-time. As the person is speaking, their words are being translated into voice, which allows it to be more accurate because we’re able to understand the context.

Keri: Where can companies start with implementing voice AI in banking?

Mike: For people building custom voice assistants, the speech recognition part can be fairly complex, but there are third parties that can provide it.

For example, at SoundHound we have our Houndify Voice AI platform. We provide transcription capabilities. If you’re interested in building your own natural language understanding, but you still need to turn the speech into text, we can do that.

A lot of natural language understanding uses keyword detection. For example, in banking, if you said something like “what’s my balance?”, it would read back the balance. It’s not going to assume it’s any other form of balance, such as a balance beam. If the voice assistant knows the user is talking about banking, it’s never going to respond about something that’s not financially related. An understanding of cross domains doesn’t need to be a factor. Ultimately after that, once you have the NLU, it needs to tap into a body of knowledge.

A lot of organizations think they can solve it and try to build their own. The other opportunity is to partner with an organization like ours. Financial institutions want a powerful, conversational assistant, mainly because it’s one thing for users to make simple phrases, such as “what’s my balance” or “I want to transfer money”, but people don’t speak that way. We want a conversational voice system. What we have is the ability to have much more complex, compound, conversational experiences, which gives everybody a running start to focus on what they do best, which is servicing the customer and not having to reinvent technology that companies like ours have put a decade-plus of innovation into.

Once you have the voice technology, you can make it available anywhere, such as over the phone or in ATMs. Voice simply unlocks so much of what you can do with a service, and banking organizations are attuned to that.

Keri: How do you balance the need for security and privacy with voice assistants in banking?

Mike: Even a few years ago banks and financial institutions were not as aggressive in the voice space because of security concerns. They’ve made strides since then. The need for security was a limiter to innovation. They’ve overcome a lot of those hurdles to a point where you can now access your bank information on third-party devices like Alexa.

The industry has adapted to be cloud-based, on-demand, and in more places than one. As a result, that has opened the door to doing a lot more innovative work in voice AI. Maintaining those security protocols but being adaptable is the mix. There are some user-facing technologies that they’re employing to differing degrees. One is biometrics, recognizing your voice and speech patterns, which is a capability that we have, and there are also voice passwords or codes.

Two-factor authentication is the key, and it’s a highly secure way to take one data point that is unique to the person and combine it with another, both within your control. You start to get very high capability rates. Some of them are inherent, like a voiceprint or fingerprint, and then some are known like a voice password or written password. You have pretty high security at that point.

Keri: What are your thoughts on voice AI’s relationship with customer service reps?

Mike: As far as customer service reps, it’s really about optimization and focusing on where people can make the biggest impact. Once upon a time, if you wanted to do any banking, you had to go into a branch, and branches would get overwhelmed and the lines would get long. So ATMs became the norm. That way, if you needed to talk to a person in your branch, you could. If you needed to do a regular transaction, you would go ahead and do it at the ATM.

This has also been happening over the phone. They introduced IVR phone systems that people hate. Customers have to figure out complex menus, which often create negative experiences. Companies implemented them simply to keep up with the demand and to be able to provide the range of services that they need. In many ways, a truly conversational voice assistant is rescuing a lot of these investments that banks have made so that their customers can have a better experience.

You can much more seamlessly integrate humans into the mix versus feeling like I’m either talking to a machine or I have to talk to a person. It’s giving them more tools to allow them to focus their people on what matters.

Keri: Why is customizing voice assistants an important element to add to any financial conversational AI?

Mike: It comes down to confidence and trust. A lot of times when you see powerful experiences with voice AI, the thing that takes it across the line for people is how natural the voice can sound. If I’m making a transaction, placing a restaurant reservation, or simply asking for directions, the words that are said are less important than how it’s said, since humans derive meaning from sound.

People at a conscious and subconscious level infer so much from the voice that’s speaking back to them. The style and tone that your organization puts forward will directly impact people’s interpretation of how capable you are. Consistency is the next component, and it’s key. If you hear the same voice over and over again, and it’s already conveying the type of trusted qualities that you’re looking for, it becomes an extension of your brand.

The same way you have a logo, color scheme, or design, people will associate the voice you use with your brand, which extends into sonic branding. If there’s a sound or any non-verbal audio cues that you use to convey that something’s happening, those all become key components of the experience to a point where customers associate that with your brand.

Keri: What advice can you give banking institutions that want to implement voice assistants?

Mike: It’s really about focusing on what channel they want to work on first. It’s the classic build versus partner approach. They have to check out what’s available and build their teams to focus on delivering a personal, branded experience.

How do they partner with the right organizations? For example, a company like Read Speaker, if they want text-to-speech, that’s a very unique technology that they’re probably not going to build themselves when it comes to conversational voice AI. That’s what SoundHound does and we do that very well.

We can bring a lot of innovation to light through that partnership, but there are still elements that banks are going to want to own.

Dive deeper into voice AI for banking

Banks and financial institutions are increasingly investing in voice assistants to deliver fast, convenient, and hands-free customer experiences. As more banks add voice AI to their annual budgets, we’ll continue to see an increase in voice technology innovations that optimize customer interactions. If your company isn’t currently investing in voice assistants, you may want to seriously consider the benefits of voice technology before your customers open accounts with a voice-enabled competitor.

If you missed it live, or if you want to see it again or share with a colleague you can view the interview in its entirety here.

At SoundHound Inc., we have all the tools and expertise needed to create custom voice assistants and a consistent brand voice. Explore Houndify’s independent voice AI platform at Houndify.com and register for a free account. Want to learn more? Talk to us about how we can help bring your voice strategy to life.